Process Proper Building Permits The First Time

Imagine shopping online and being met with an abnormal experience. While preparing to check out, you find that the retailer won’t provide the shipping cost or sales tax as part of the final cost. They are leaving you to find the shipping company, identify the sales tax rate, and calculate the total price. Would you even shop online if this was the standard experience? We think not. Such an approach would not last long in today’s e-commerce world; however, this is the insurance and construction industries’ status quo.

Just as Amazon set the standard for retailers and customer expectations,

the tools have finally arrived for insurance companies and contractors to process property claims with ease and accuracy in seconds.

As the pace of change surrounding big data continues to increase, it is merely a matter of time until property claims will be digitized thanks to insurance companies and their technology partners’ incredible efforts. Digitization will inevitably save the property insurance industry billions of dollars in claims processing, and it will change the customer experience forever.

As the pace of change surrounding big data continues to increase, it is merely a matter of time until property claims will be digitized thanks to insurance companies and their technology partners’ incredible efforts. Digitization will inevitably save the property insurance industry billions of dollars in claims processing, and it will change the customer experience forever.

The foundation for automating the claims process, and any other digital platforms, is good, clean data. For insurers, adjusters, and contractors alike, reliable data is the key to processing claims digitally. As permit fee schedules and other related information is unlocked from the shackles of manual processes, the customer and the contractor will finally share the fruits of this digital revolution.

Local building departments manage roofing codes and other building regulations by processing applications and collecting permit fees, albeit inefficiently. This process is in need of a systematic change to properly align all major stakeholders in calculating the permitting costs quickly and accurately.

Local building departments manage roofing codes and other building regulations by processing applications and collecting permit fees, albeit inefficiently. This process is in need of a systematic change to properly align all major stakeholders in calculating the permitting costs quickly and accurately.

According to one trusted source, ‘when permitting is done properly, the impact on the insurance industry is fantastic.’ However, there is no consensus on what is meant by ‘proper permitting.’ To create defensible and accurate claims estimates, one would need to calculate the permitting cost associated with each project accurately. Seamless integration of permit data via a digital platform allows for instant access to proper permit fee calculations. Such an improvement would save the construction and insurance industries hundreds of millions of dollars each year.

The top U.S. insurance companies and their technology partners are paving the way to fully automate the claims experience, and at the same time, empowering the consumer to choose. They are doing so by transparently exposing cost information, and like many other digital platforms, the focus is on creating trust between all stakeholders. With these key trust factors, combined with the desire to automate claim workflows, it is time for the crucial data to bind the whole process together and replace the broken and manual system.

PROBLEMS OF PERMITTING TODAY

Rapid and accurate indemnification of the property owner is based on being accurate when estimating a property repair. In 2020, there is no quick ability to research building permit costs in an automated and precise fashion. Any online search for an application or third party service is met with disappointment. The choices available to front line adjusters or contractors are scarce, leaving them to find permit costs for each project manually. Though municipalities have robust websites, the permit cost information is rarely available. Few cities or counties have a modern and efficient online database to quickly or accurately return the permit cost information without applying and paying for a permit.

Existing construction estimating platforms do not provide an automated or accurate method to streamline the claims process due to missing critical pieces of data. Building codes, jurisdictional authority, manufacturer specifications, and permit fees are missing from such platforms. For permitting purposes, this leads to two interrelated problems:

These problems are exacerbated by new and old situations, including compliance issues, conflicts of interest, and, most recently, COVID-19.

Insurance regulators require insurance companies to estimate all known costs at the initial investigation. This includes the cost of materials and labor needed to repair the property inclusive of

sales tax, permit fees, and any other known costs. Insurance companies and contractors alike have not had a simple way to calculate the permitting fees associated with each project. Therefore, consistently omitting the permit fee is, in its nature, not transparent and renders both parties out of compliance because they are knowingly underestimating the total project cost.

Across the country, permit fees vary because they are based on the project valuation submitted by the contractor at the time of application. Since a lower

project valuation results in a lower permit cost, contractors are incentivized to provide a lower valuation to keep the overall costs down. This is magnified

by the fact that there is no clear way to enforce a penalty for an underestimated project valuation without incurring costs that outweigh the benefits of investigating such actions. Insurance companies

tend to find themselves complicit in this institutional bias by omitting the

requirement for permit costs as part of the initial investigation.

The COVID-19 pandemic has put unique pressures on the claims adjusting process. In 2020, calling municipal offices to obtain key pieces of information is not a consistently viable option. Governments across the country have closed their doors to the public or limited their hours, requiring email or online submission as the primary form of communication. This can result in ambiguity surrounding the questions and answers posed by the caller, which is amplified by the inherent delays in the response via digital communication.

CREATING A SCALEABLE MODEL

Permitting is the municipal process that allows improvements to be made to a property structure. Be it a minor addition or large scale construction, permitting fees depend upon each project’s value.

Nevertheless, for a big data solution, handling the variations in project size and corresponding fee structures is a relatively simple task. Digitization can effectively eliminate the problem faced by insurance carriers and contractors of not knowing the accurate permit cost. Virtually any permit fee can be obtained anywhere in the country based on just a few simple pieces of data:

A single source of truth that both identifies the corresponding jurisdiction and stores permit schedules for each project address is the only reliable combination for accurate estimates.

A rigorous data collection process must occur to obtain the permit fee schedules for over 20,000 jurisdictions across the country. At least two semi-annual phone calls and online research need to be conducted to confirm the current permit fee schedule. Through our proprietary algorithm, we also have the unique ability to forecast and anticipate changes in the second half of the year.

The first contact with the local municipalities is scheduled from January-April with anticipation that municipalities tend

The first contact with the local municipalities is scheduled from January-April with anticipation that municipalities tend

to change or update their permit fees according to the latest adopted fee schedule. A second communication later in the year validates the permit schedules that have not changed as well as those that did. It is vital to supplement these regular calls with national weather and storm tracking, live calling and updating in the wake of severe weather and other catastrophically ravaged areas within 24-72 hours after the storm.

After the raw data is collected, a sampling process can be undertaken to ensure a statistically significant accuracy threshold. The verified fee schedules, including the mathematical formulas that govern them, can then be uploaded to a central database.

Thus, a traditional fee structure for a given municipality is digitized and quickly

transformed into an easy to use platform for all parties involved. That’s how we make it easy!

Amid the era of streamlined claims processes, centralization of permit fee schedule data is finally a possibility.

Amid the era of streamlined claims processes, centralization of permit fee schedule data is finally a possibility.

We can now envision the permitting process and associated fee calculation in seconds, not hours.

Delivery of instant, automated, and accurate permit costs helps solve the more significant problem of variability in estimating claim costs. It forces agreement on overall project valuation in advance, a key lever for solving the persistent problem of repair cost disagreements.

This improvement alone will save millions of hours in lost time each year in the claims process for a relatively minimal cost. An increase in the percentage of projects that are permitted correctly before work begins, by definition, allows municipalities to enforce codes that protect communities. If the insurance company and contractor can estimate more accurately and timely upfront, the customer experience is elevated to be in line with today’s expectations of instant gratification.

The path forward to automation is based on building a repeatable methodology of identifying property specific permitting and building code data in a digitized format to move beyond antiquated processes.

Today, consumers seek out copious amounts of information online allowing them to make the best purchasing decisions for themselves with little effort. Providing contractors and

claims professionals the ability to deliver these same consumer expectations through digital tools allows them to make better- informed, as well as more accurate and defensible decisions when it comes to their home restoration.

The digital transformation of the insurance industry and the dozens of new efficiency tools have had a ripple effect on the entire property claims process.

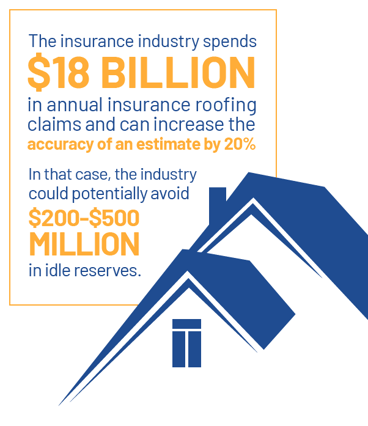

Automated and accessible permitting, inherently linked with local building codes, ensures fairness for the consumer, insurer, contractor, and municipality. Providing a clean and straightforward interface allows individuals and companies to obtain permit fees based on correct jurisdiction, which streamlines the process, saves millions of hours of wasted time, and millions of more dollars in inefficient use of investments. The insurance industry spends $18 billion in annual insurance roofing claims and can increase the accuracy of an estimate by 20%. In that case, the industry could potentially avoid $200-$500 million in idle reserves.

Once a tool for streamlining the permitting process becomes readily available to the market, the question will always arise as to whether an investment in the tool is sound.

When such a tool enhances compliance, saves money, and delights its stakeholders in the process, it becomes hard to refute, and the return on investment becomes obvious.

As such, an obvious cost-saving tool becomes more readily accepted in the marketplace. It also tends to become more prevalent, and then the market expects it as a baseline.

Contractors and claims professionals take pride in a job well done and their ability to provide excellent customer service. Inaccurate permitting fees and other broken links in the estimating process stem from not having all the necessary information upfront. Technology can level the playing field, helping both parties refocus in order to provide quality work and customer service, avoiding unnecessary administrative processes. Therefore, technology puts the power back in the hands of the consumer and allows them to make a more informed buying decision. It also returns the focus to the quality and reputation of the contractors and claims professionals, which enables them to serve everyone more faithfully and proudly.

About OneClick Code

OneClick Code is a trusted data partner, dedicated to streamlining the code-sourcing process for all parties in the roofing industry while also increasing efficiency and transparency for all stakeholders in construction and restoration. They have the only platform to have blazed the trail for data automation of jurisdictional authority for building codes, permit fees, taxes, and manufacturer specifications required for any address nationwide. OneClick Code has been serving customers in the contracting, insurance, and claim adjusting fields by providing instant access to trusted roofing codes, in the click of a button. Offering unique reports that can be easily shared between all stakeholders in the roofing claims industry, OneClick is adding value to all parties and empowering customers to save time and money on every claim. Welcome to restoration intelligence, automated. To learn more, visit our website www.oneclickcode.com.