Turning Problems into Potential Using Insurance Technology Solutions

The COVID-19 global pandemic has changed the direction and acceleration of technology adoption in the insurance industry.

During the birth of insurance in the 1700s, the newest technologies were calculus, coffee, and chemistry. It was a world in which ship captains and their crews set off for months at a time around the world, engaging in the first wave of globalization backed simply by signatures of faith. In 2020, the COVID-19 global pandemic has changed the direction and acceleration of technology adoption in the insurance industry. As little as three years ago, technological advancements that seemed impossible, such as digital underwriting and automated claims systems, will be the new standard for all aspects of insurance moving forward.

2020 will go down as a year of revolutionary change in insurance, from the potentially industry-breaking COVID-19 pandemic to the expanding digital workforce and adoption of new cloud-based processes. While the epidemic may cause solvency issues for some insurers in 2021, the industry avoided what could have been an insurmountable bill of up to $431 billion per month for loss of revenue owed to business owners due to COVID-19 related closures.1 The U.S. Government stepped up to foot the bill, avoiding complete disaster once again.

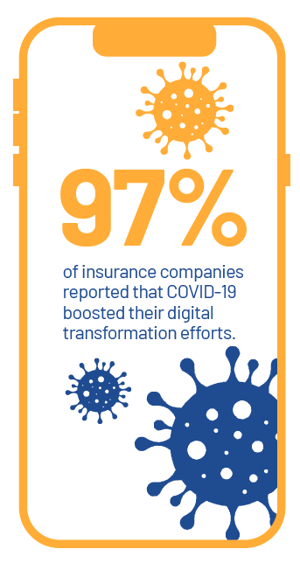

Amidst this industry upheaval, digital transformation in cloud-based insurers provides superior customer experiences to those who have not adopted technological advancements. In claims, for example, insurance companies that rely on digital customer interactions see an 85% reduction in time to settle a claim, a 60% reduction in touchpoints, and a 15% increase in customer satisfaction.2 Is it any wonder that 97% of insurance companies reported that COVID-19 boosted their digital transformation efforts? The implications of 2020 and the pandemic for the insurance industry will be the subject of technology discussions for decades. Painting a broad picture of the P&C industry in late 2020, we can dive into the pandemic and its effects as well as the trends and attitudes that will shape the next decade of growth in insurance.

ACCELERATING TOUCHLESS CLAIMS

“Clients, agents, and brokers should continue to report claims through available digital channels and over the phone. We have dedicated claims representatives available 24/7. You can view claim reporting options here. While we will still be able to receive requests through traditional mail, we encourage you to submit claims through the available electronic options and to correspond with your claim adjuster through electronic methods for faster responses.” 3

The COVID-19 pandemic has driven businesses worldwide to rethink how their employees and customers use technology or risk falling behind. Not since the mass adoption of desktop computers has such a technological shift been so widespread. Insurers, their claims departments, and their IT departments are compelled to rethink the entire claims adjusting process. Due to public health office restrictions, simply calling local municipal offices for information is more laborious and inconsistent than ever. Email, online inquiry, and even text communication have temporarily become the primary forms of interaction, and for many municipalities facing budget crunches, this could be the new status quo.

“Following a hailstorm, tornado, or other major weather event, insurers are relying on InsurTech and other technologies to provide information instead of sending adjusters to investigate the damage. Drones, infrared cameras, and cell phone apps are helping to fill some of these gaps.”

“In the past, a policyholder would often physically meet with their insurance provider to investigate a claim, and that option suddenly ceased in March,” detailed James Brown, CEO of Smart Communications. “This forced insurers to shift toward a digital-first business model and put more resources toward digital transformation initiatives such as offering digital forms and making it possible to start a claim on one device (such as a mobile phone) and complete it later via desktop, for example.

While it may have started as a way to serve customers better during this difficult time, we fully expect this trend to continue. Consumers have been craving more convenient digital interactions for some time and now will remain loyal to companies who continue to offer this option moving forward.” 4

TURNING PROBLEMS INTO POTENTIAL

2020 is becoming one of the ugliest years on record for the insurance industry from a profit and loss perspective. Massive lawsuits linked to business interruption cases, logistical issues surrounding the investment in a new remote workforce, and massive payouts in specific sectors due to event and travel cancellations are all producing severe headwinds. The uncertainty surrounding 2020’s profit and loss for many insurers and the continuing distress from COVID-19 may manifest as insolvency issues. Trade credit insurance, mortgage insurance, workers’ compensation insurance, and other lines all face solvency risk due to the economy’s instability and rising unemployment. This solvency risk could potentially result in an insurmountable bill of up to $431 billion a month for required payouts from revenue lost and expenses owed to business owners due to COVID-19 related closures.5

COVID-19 has simultaneously exposed unique technology challenges facing insurers and their digital infrastructure.

For instance, only 34% of policyholders said they were able to easily communicate wit

h their insurance companies to ask questions or make modifications.6 Examples of 1,000% increases in new customer inquiries have been noted from a year prior, overwhelming call center workforces.7 Overseas call centers, back offices, and IT development departments have had a roller coaster ride due to the uncertainty surrounding the virus’s worldwide spread and its effect on operations.

Agents, field adjusters, and other service providers have also been forced to adapt to this shifting environment. Agents typically rely on in-person meetings and close contact with customers, which is now risky in many states and major metropolitan areas. Other claims handling norms, for adjusters who are used to going on-site and having full access to any property, are being completely rethought. Evolving adjusters now have to learn and adopt new tools. In addition, agents and brokers are being pressed by their customers for updates in pricing and coverage. Such requests necessitate significant time and staff to provide these updates to the customer. Considerable time and staff increases are something that many small brokers and independent agents simply do not have, given their current payroll and revenue crunch.

Unfortunately, as COVID-19 continues to bring incredible suffering to millions globally, it has provided fertile ground for increased insurance fraud.

The correlation between high unemployment and insurance fraud attempts has been well established for decades.8 Moreover, spoofing, tampering, and all other types of persistent and emerging digital threats are likely to cause more problems for insurers as they continue the shift to remote, cloud, and digital operations in 2021 and beyond.

SOLUTIONS THAT BRING STABILITY

With all of this unprecedented stress on the insurance industry combined with an increasingly difficult employment situation and social crises, there is still much that insurers can do to create a successful future. On average, insurance companies that rely on digital customer interactions see an 85% reduction in time to settle a claim, a 60% reduction in touchpoints, and a 15% increase in customer satisfaction.9 Insurance executives that see these statistics and have watched technology-dominant business growth during this time can easily understand the need for greater adoption of their digital strategy.

The first and best way for insurers to evolve is to start adopting technology for the claims side of the operation, given the enormous advancements in InsurTech in the past decade and the increasing pressure on claims teams due to the COVID-19 pandemic.

Prior to the pandemic, roughly 11% of auto insurance customers used virtual claims applications. In early April 2020, during the initial height of the epidemic, Allstate estimated that customers would submit more than 90% of its auto claims via its virtual tools.10 Access to remote inspection tools is becoming so prevalent that a recent trend is for insurers and data providers to offer these tools at no charge.11

As insurers modernize the claims experiences for customers, they will also look closely at their underwriting processes for additional efficiency gains. Carriers will be looking to save money by adopting technologies and determining which areas of the business should be modernized. Inevitably any business division that embraces the digital revolution will rise to the top. Conversely, any division that doesn’t do so will need to have other ways to endure in the post-COVID-19 world.

Automating end-to-end customer journeys makes the claim process more efficient and effective in handling large volume spikes, such as those experienced during COVID-19 or catastrophic storms. Scalable self-service chatbots, natural language processing, artificial intelligence, seamless user interfaces, automated data, and personalized experiences for the customer will result in a double win for insurers: lower costs and happier customers.

POST COVID-19 FUTURE

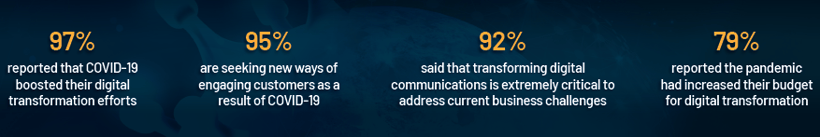

In an early pandemic survey by Twilio12, the following responses sum up how COVID-19 has impacted insurers and their outlook on a more digital future:

Based on these findings, it is clear that digital evolution over the next five years will enhance digital underwriting and digital claims experiences. Maximizing customer lifetime value, achieving 90%+ retention, and elevating brand awareness is essential for a digital provider in this new landscape. The future for InsurTech companies will be governed by customer expectations, seamless digital underwriting, and connected claims processes.

DIGITAL CLAIMS

Servicing claims in a viral environment is daunting, but the added pressure of servicing affected catastrophe or other claims victims that are already stressed financially can be toxic for companies and third party adjusters alike. Even the best AI is incapable of handling such a burden.

Only speedy and trustworthy communications and payouts can help alleviate such stress. The future of insurance in a post-COVID-19 world will depend on improving and adopting remote adjusting applications that streamline information and communication processes for both adjusters and policyholders. These tools are already becoming permanent fixtures in automotive claims and other lines of insurance. Similar remote property adjusting tools are poised to proliferate property insurance after catastrophes, where tens of thousands of claims can happen overnight.

DIGITAL UNDERWRITING

The future of the digital customer experience for underwriting and distribution is already here in 2020. Fully integrated digital carriers and leading digital brokers cut personal lines and small commercial underwriting processes down from hours to minutes. The most significant advances are still ahead as insurers get better at navigating the oceans of data and correlating it with expected losses.

In 2020, both P&C underwriting and claims processes are shifting so rapidly to digital processes that it is almost impossible for any but the most advanced carriers to keep up. To combat falling behind due to rapid advancement, P&C carriers are focused on finding the right partners to integrate into their digital platform.

The ease of integration with existing cloud-based tools and infrastructure can make all the difference in aligning both underwriting and claims with a fully digital experience and further siloing outdated workflows.

A BRIGHTER, MORE TECH-DRIVEN TOMORROW

COVID-19 has forced companies to increase their adoption and usage of InsurTech solutions to accelerate their digital growth and stay current in today’s insurance market. Customers that have been yearning for an automated solution are welcoming this acceleration, while those who are not tech-inclined are finding some aspects of this change difficult. Yet many customers are getting used to the idea of remote inspections, digital processing, quick claims payments, effortless customer service, and reduced repair times.13

The digital insurance revolution has undergone a massive acceleration since March 2020. Insurers have become cloud-based, savvier about integrating new tools, and partnered extensively with various tech startups. Insurance companies have been spurred on by billions of dollars in InsurTech investments since 2015 when the idea of achieving a digital revolution in the industry by 2030 seemed to be an attainable timeline. Because of COVID-19, the digital revolution has come early.

The industry deserves tremendous credit for taking advantage of these technological opportunities leading up to the crisis. They established specialized InsurTech conferences and regional industry groups and hired a digital workforce that complemented the existing bastion of statistical, underwriting, and claims processes that have been its bedrock since the 1700s.

Back then, the new technologies were calculus, coffee, and chemistry. It was a world in which ship captains and their crews set off for months at a time around the world, engaging in the first wave of globalization backed simply by signatures of faith. In the 21st century, the insurance industry manages to turn its worst digital laggards into zealous adopters of technology. Ironically the industry is doing so by abandoning the pen that gave it life and the antiquated platform that sustained it in favor of a digital future that, until recently, appeared unattainable. Welcome to the digital InsurTech revolution.

1 www.insurancejournal.com/news/national/2020/06/12/572004.htm

3 www.libertymutual.com/covid-19

4 Property Casualty 360° - Handling CAT Claims in a COVID-19 world

5 www.insurancejournal.com/news/national/2020/06/12/572004.htm

6 www.lightico.com/blog/insurance-claims-in-a-covid-19-world-the-mandate-technology-to-streamline-claims/

7 home.kpmg/xx/en/home/insights/2020/04/covid-19-insurance-operations-challenges.html

8asianbankingandfinance.net/solution-center/protecting-and-defending-financial-institutions-financial-crime-and-cyber-attacks/fr#:~:text=Here%20are%20a%20few%20of,claims%20totalled%20%C2%A3560%20million

9 www.lightico.com/blog/insurance-claims-in-a-covid-19-world-the-mandate-technology-to-streamline-claims/

10 www.cfo.com/the-cloud/2020/06/three-ways-covid-19-is-accelerating-digital-transformation-in-professional-services/

11 www.verisk.com/insurance/visualize/addressing-the-challenges-of-covid-19/

13 www.forbes.com/sites/steveandriole/2020/05/19/mckinsey-accenture-and-everyone-is-right-about-digital-life-after-covid-19-but-were-not-ready/

Patent Pending. All Rights Reserved. OneClick LLC. Proprietary and Confidential

About OneClick Code

OneClick Code is a trusted data partner, dedicated to streamlining the code-sourcing process for all parties in the roofing industry while also increasing efficiency and transparency for all stakeholders in construction and restoration. They have the only platform to have blazed the trail for data automation of jurisdictional authority for building codes, permit fees, taxes, and manufacturer specifications required for any address nationwide. OneClick Code has been serving customers in the contracting, insurance, and claim adjusting fields by providing instant access to trusted roofing codes, in the click of a button. Offering unique reports that can be easily shared between all stakeholders in the roofing claims industry, OneClick is adding value to all parties and empowering customers to save time and money on every claim. Welcome to restoration intelligence, automated. To learn more, visit our website www.oneclickcode.com.